According to the latest Nationwide House Price Index (HPI), the average price of a home in the UK fell by 0.8% in August. This means prices are now 5.3% lower than they were at their peak in August 2022.

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: “The softening is not surprising, given the extent of the rise in borrowing costs in recent months, which has resulted in activity in the housing market running well below pre-pandemic levels. For example, mortgage approvals have been around 20% below the 2019 average in recent months and mortgage application data suggests the weakness has been maintained more recently. Nevertheless, a relatively soft landing is still achievable, providing broader economic conditions evolve in line with our (and most other forecasters’) expectations.”

Commenting on the figures, Robert Gardner, Nationwide's Chief Economist, said: “The softening is not surprising, given the extent of the rise in borrowing costs in recent months, which has resulted in activity in the housing market running well below pre-pandemic levels. For example, mortgage approvals have been around 20% below the 2019 average in recent months and mortgage application data suggests the weakness has been maintained more recently. Nevertheless, a relatively soft landing is still achievable, providing broader economic conditions evolve in line with our (and most other forecasters’) expectations.”

Robert said that unemployment is expected to remain low (below 5%) and the vast majority of existing borrowers should be able to weather the impact of higher borrowing costs, given the high proportion on fixed rates, and where affordability testing should ensure that those needing to refinance can afford the higher payments. “While activity is likely to remain subdued in the near term, healthy rates of nominal income growth, together with modestly lower house prices, should help to improve housing affordability over time, especially if mortgage rates moderate once Bank Rate peaks.”

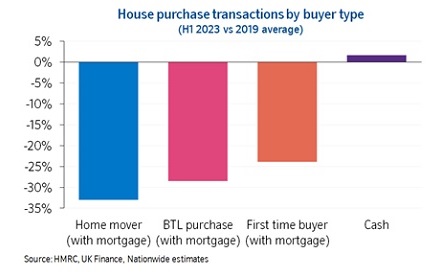

Home mover completions (with a mortgage) in the first half of 2023 were 33% lower than 2019 levels, whilst first-time buyer numbers were around 25% lower. Buy-to-let purchases involving a mortgage were nearly 30% below pre-pandemic levels. By contrast, cash purchases were actually up 2%.

Nicky Stevenson, Managing Director at national estate agent group Fine & Country commented: “Despite the pressure on budgets, people have got used to the higher rate environment, and many homes are now being priced accordingly to attract interest and offers. As we come out of the summer, demand is expected to build again, and many sellers are looking to begin marketing their home in September. A steady pipeline of sales, coupled with falling inflation and a strong labour market, should help the property market enjoy a soft landing over the coming months.”

Iain McKenzie, CEO of The Guild of Property Professionals, said: “The industry has proven resilient to this volatility throughout 2023, with the picture a lot less gloomy than previously forecasted. House prices are still well above pre-pandemic levels, but homeowners that haven’t reacted to the changing outlook may find that their property is slower to sell. The sluggish rate of mortgage approvals throughout the year has caused a significant decrease in the number of first-time buyers getting their foot on the property ladder. All eyes will be on the next few months. Demand usually remains high in the autumn, as potential buyers look to get moved in before the festive season. With sales figures still buoyant, it is unlikely that we will see any sharp falls for the rest of the year.”