Last time the US faced a financial crisis of this current magnitude was in 2008, when the subprime mortgage crisis and the failure of financial institutions plunged the country into a recession.

Taking into account the toll the 2008-2009 crisis took on the moving industry in terms of revenue, number of establishments, jobs, and payroll, based on current economic projections, the toll is likely to be similar this time around.

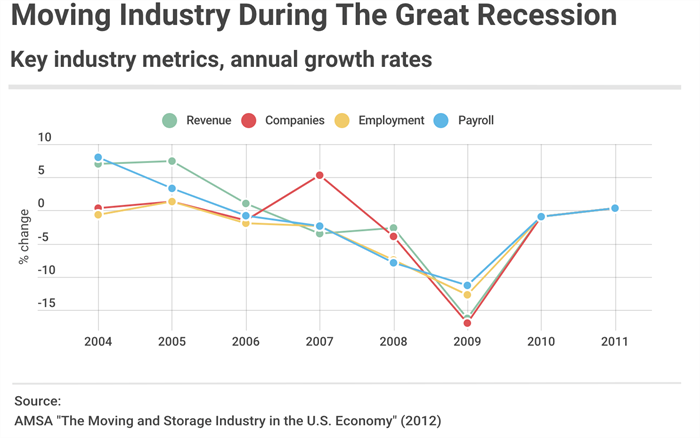

According to a related 2012 study of the moving industry in the years of the Great Recession (which we note was commissioned by the American Moving & Storage Association), it took until 2011 for the industry to recover – that’s about four years. ‘Recovery’ as operationalised by this study means ‘a return to growth in revenue, employment, number of companies in the industry’.

Based on AMSA’s study, at the peak of the recession (i.e., 2008-2009), our key metrics fell by:

- Revenue: -16.5%

- Establishments: -17.2%

- Employment: -12.8%

- Payroll: -11.3%

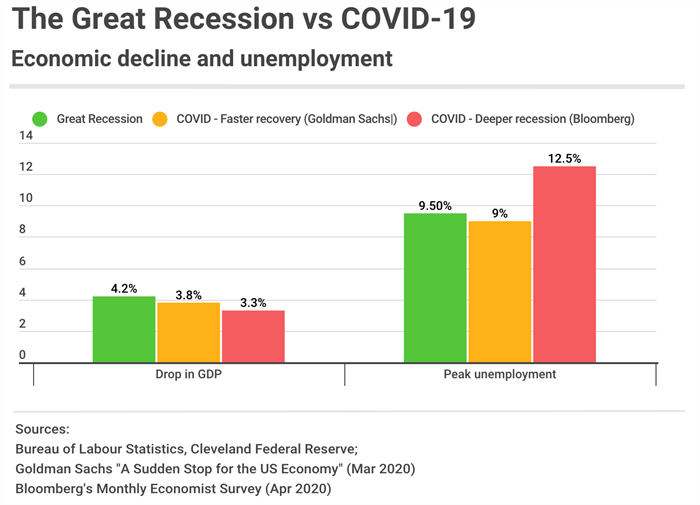

Within the same period, the US recorded a peak unemployment rate of 9.5% and a 4.2% drop in GDP, signalling an extremely difficult time for the economy and the country.

How these industry-specific and broader metrics behaved during the recession of 2008-2009 allows us to estimate what the COVID-19 pandemic may cost the moving industry in 2020.

Predicting the unpredictable about the 2020 crises and beyond

To assess the impact of the COVID crisis on the moving industry, we started with the same two metrics we measured for the Great Recession: change in the GDP and unemployment rate.

Here are the drops in GDP and peak unemployment rates for the Great Recession, followed by Goldman Sachs and Bloomberg’s estimates for the COVID-19 pandemic.

Unlike with the Great Recession, these 2020 figures are limited to three months. (And while some projections are wrong more often than not, that’s all we have to go on so far.)

We took our projections on these metrics from two reputable sources: Goldman Sachs and Bloomberg’s survey of economists. While both predict an approximate 3.5% decline in GDP in 2020, compared to 2019, Goldman Sachs is a lot more optimistic than Bloomberg’s panel when it comes to the unemployment metric.

Armed with these figures, we aimed to answer the following question:

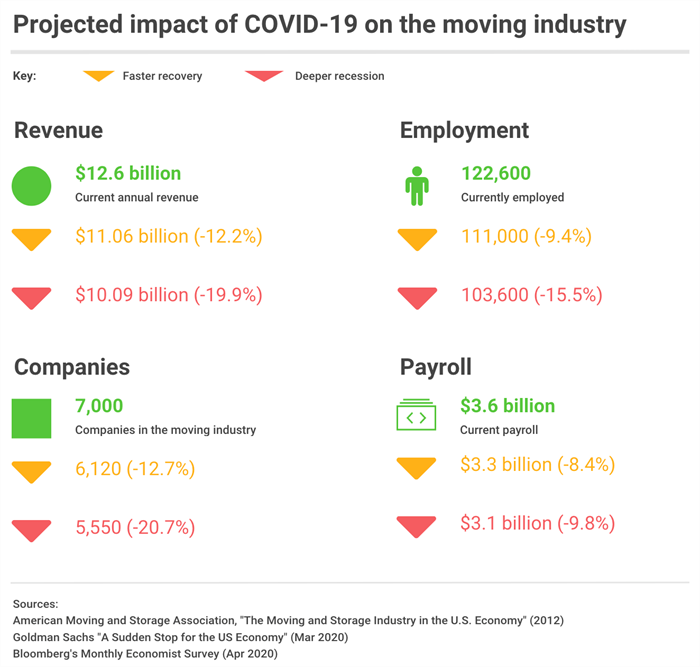

If during the Great Recession the moving industry lost 16.5% of its revenue, what can we expect based on the projections for COVID-related economic crisis?

Taking into account the toll the 2008-2009 crisis took on the moving industry in terms of revenue, number of establishments, jobs, and payroll, based on current economic projections, the toll is likely to be similar this time around.

Beyond the immediate impact, a worrying trend

If the Great Recession is any indication, it could be up to four years before the moving industry rebounds to its previous rates.

The number of people moving in the US every year has been on a steady decline since the mid-90s.31.4 million people moved in 2019 – almost one million fewer than the year before.

Top reasons for moving last year were:

- New or better home: 17.0%

- New job or job transfer: 12.1%

- Establish own household: 11.4%

The top reasons for moving in 2019, based on our study of over 25,000 moves in 2019, were all for reasons that will be heavily impacted by a crashed economy. It’s difficult to imagine a scenario where forces behind these reasons (e.g., job creation, the housing market) all experience a quick recovery. Last time we were in a recession, the number of people moving dropped almost 10% year-over-year.

Based on current economic projections, we estimate the number of people moving could be between 6% and 9% lower in 2020 than the year before.

The moving industry is hoping for the best, preparing for the worst

Comparing the consequences the COVID-19 pandemic will have on the economy to the recession of 2008-2009 is, of course, speculative. And whereas the finance industry seems to be divided over how strongly the coronavirus pandemic will affect the nation’s economy, they seem to agree on one thing: much like the impact of the Great Recession, the impact of COVID-19 will be negative.

Still, at the moment, it’s impossible to rule out either ‘rapid recovery’ or the ‘deep recession’ scenarios. A quick recovery is exactly what some companies in the industry are hoping for.

Ben Cross of University Moving and Storage Co, an agent of the North American Van Lines told us, “April is trending about 60% down for our corporate business, but we expect that to come back in June.”

He added, however, that the comeback depends on “whether 100% of the moves that didn’t happen in March, April and May end up moving at all”.

Like many other questions, this one will be answered when the true effect COVID-19 has on the economy, including house sales and jobs creation which are both big drivers of people’s moves in the United States, is revealed.

Until such time, we can anticipate that COVID-19 will have an impact similar to the Great Recession of 2008-2009, while holding out hope it won’t be as profound this time around.

Images: Graphs 1-4

Editor’s Note

The 2008 crash and the COVID-19 pandemic are similar only in that they have caused a financial recession. The COVID situation is very different: until we have a vaccine, which we may never have, we cannot go back to our old ways of global mobility. For this reason, the long-term effect is likely to be much longer lived and so a direct comparison, though interesting, may not give a true assessment of the current situation.