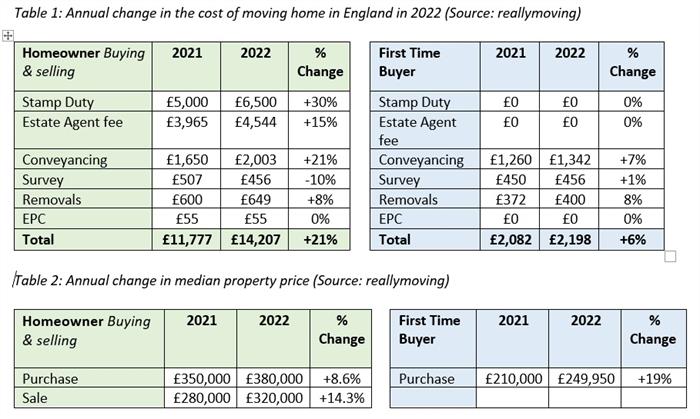

The cost of moving home has jumped 21% over the last year from £11,777 in 2021 to a new record high of £14,207, according to reallymoving’s annual Cost of Moving research.

This means that despite news of immediate and permanent cuts to Stamp Duty, a person now buying and selling a home in England is required to find on average £2,430 more in upfront costs than in 2021.

The comparison site for home movers has analysed data from 714,000 quotes in the last year to reveal that it’s more expensive than ever to move home. Despite a fall in the cost of a survey and Stamp Duty cuts announced in the 'mini-Budget’, sharp rises in conveyancing fees, estate agent fees and removals, have pushed moving costs upwards. This is due to rising house prices which directly impact costs such as conveyancing and estate agency fees (calculated as a percentage of the purchase price), as well as inflationary pressure and high demand for services.

Based on the median purchase price of £380,000, Stamp Duty is the largest expense facing home movers in 2022 at £6,500, followed by estate agent fees at £4,544 (+15%), conveyancing fees at £2,003 (+21%) and removals at £649 (+8%). Surveying costs have fallen by 10% over the year to an average of £456, while the price of an Energy Performance Certificate (EPC) remains unchanged at £55 for the sixth consecutive year.

Home movers in the North and Midlands face largest rises

The cost of moving home has risen the most in the North of England and the Midlands due to increasing conveyancing and removal costs and, in the case of the North West, due to rising house prices pushing people above the Stamp Duty threshold based on an average purchase price of £285,000. Moving costs have risen by 39% for buyers in the North West, 30% for those in the East Midlands and 30% in Yorkshire and the Humber, while movers in the North West are paying 17% more to move.

Rob Houghton, CEO of reallymoving said, “At a time of soaring inflation and rising interest rates, the prospect of record high moving costs is bound to deter some non-essential home moves. Despite the welcome Stamp Duty cuts announced in the mini-Budget, which have had a big impact on First Time Buyers in London and the South East in particular, rising house prices over the last year and the associated impact on the cost of services such as conveyancing and estate agent fees mean that moving home now eats up almost half of the average UK salary of £31,772.”

“Moving costs for First Time Buyers are thankfully more stable but with mortgage affordability declining, record high rents and rising inflation making it even harder to save, finding £2,198 in up-front costs on top of a deposit is extremely challenging.”